Agentic automation solutions

Become the choice of more enterprises Improve efficiency Reduce costsAchieve operational excellence

View customer cases Automation

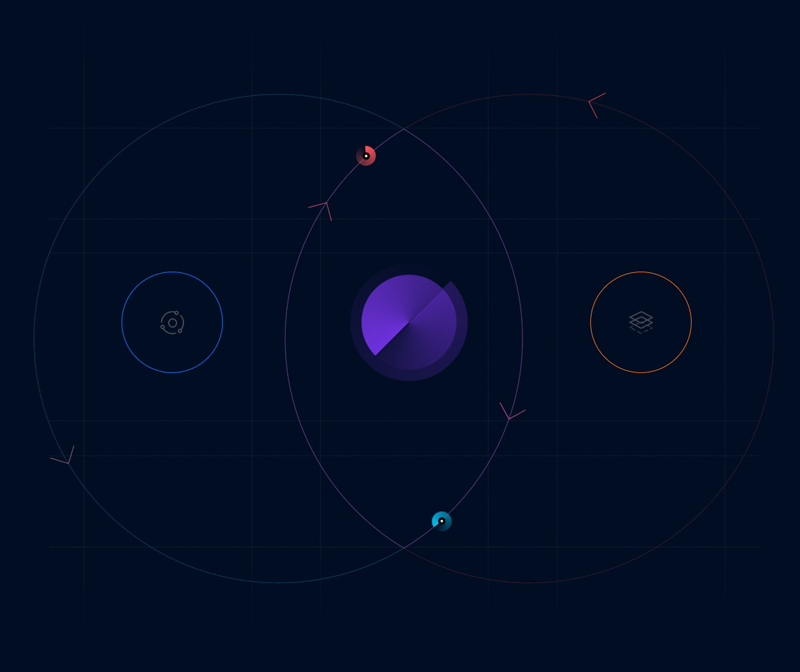

Automation

We enhance efficiency, achieve business process automation, optimization, and high scalability

Improve process efficiency through automation, achieve automation, optimization and high scalability of business processes, and bring excellent efficiency and reliability to your organization

Industrial and Commercial Bank of China (Asia) Limited (referred to as "ICBC Asia") is the overseas business flagship wholly owned by Industrial and Commercial Bank of China. As of the end of 2022, it had 49 branches and 128 ATMs in Hong Kong, including six branches such as Queen's Hill and Tsui Lam, which are inclusive banks (four of which are the only banks in the district); it has 10 subsidiaries including Hua Shang Bank and ICBC Asset Management (Global), holds local banking licenses in Hong Kong, Hong Kong Securities and Futures Commission licenses 1, 4, 5, and 9, and Hong Kong Companies Registry trust or company services licenses, providing customers with a comprehensive package of cross-border and cross-market services.

In 2019, i-Search and ICBC Asia officially began their cooperation, starting with RPA products. Currently, RPA products have achieved full coverage of core business departments. In 2023, the cooperation between the two parties took a new step, with RPM products providing strong support for further improving ICBC Asia's existing processes.

The operational staff vary greatly in their proficiency levels

Business processing involves multiple systems, and some of them are not interconnected

The work of enhancing business operations requires a deep exploration of entry points for process optimization

Employee operation behavior recording and analysis

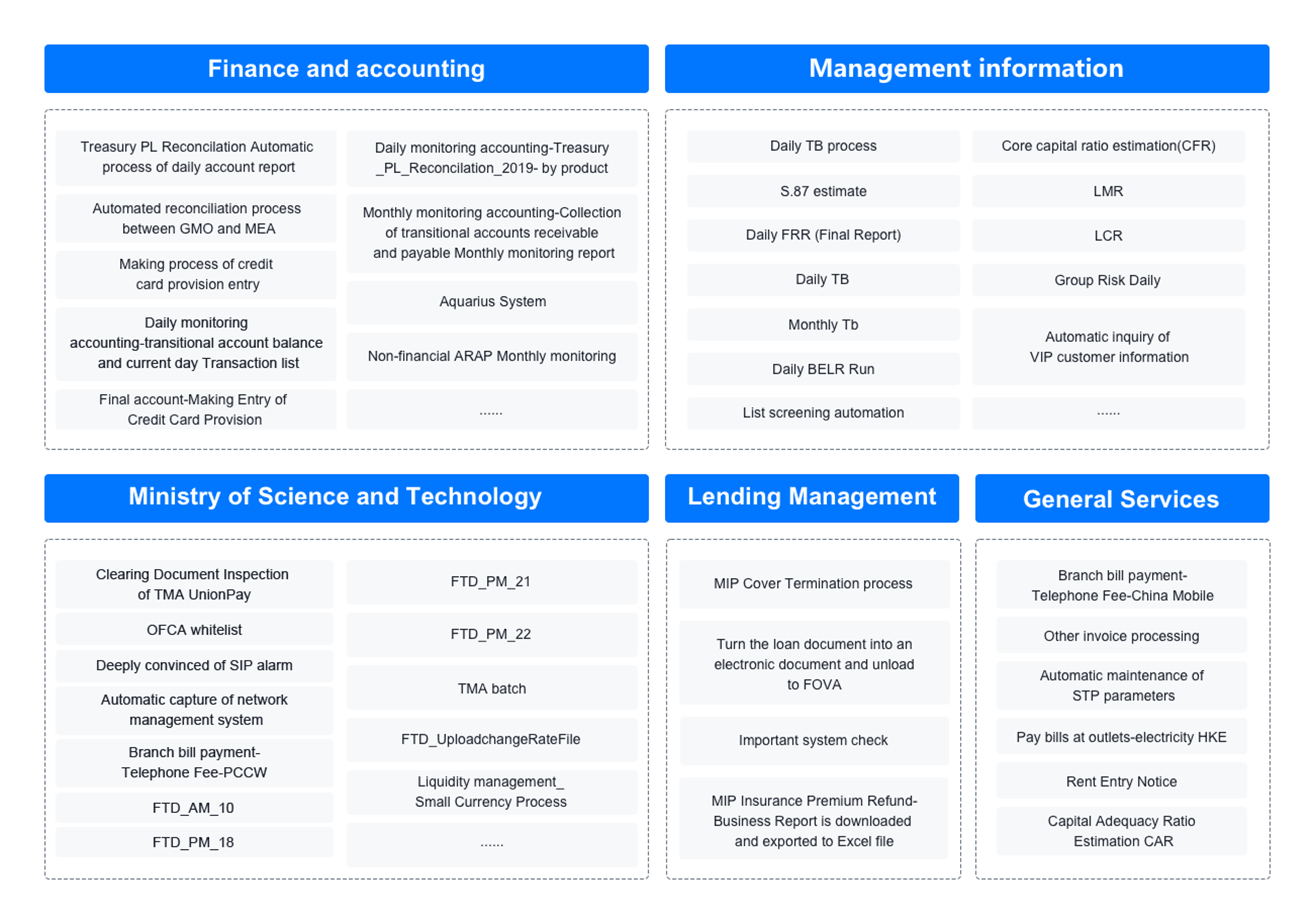

Explore application cases of RPA in the banking sector, serving 15 business departments of ICBC Asia

Initiate the construction of the ultra-automation platform

To address issues such as data silos and manual duplication, and to achieve data integration and efficient automation, RPA robots were first introduced in 22 business scenarios across the Operation Management Department, Financial Technology Department, and Management Information Department, achieving significant results

The RPA department of ICBC Asia has further expanded, covering 11 departments and one overseas business center, encompassing five major business types: report preparation, reconciliation processing, document entry, document transmission, and compliance risk monitoring. The average business efficiency has increased by 70%.

The application has been further expanded, serving a total of 13 departments, with nearly a hundred automated business scenarios launched. The automated business volume has exceeded 1 million business operations, freeing up over 30 manpower, achieving the construction goal of "replacing manpower with technology".

Pilot application of process mining technology in the operation management headquarters to build the ability to discover and evaluate process issues and automation opportunities from a global perspective, with the goal of achieving a super-automated platform capable of 'discovery, evaluation, construction, operation, and management'.

Adhering to the concept of "New Direction for Business Operations", ICBC Asia has continuously deepened the application of RPA+AI scenarios in operational management and customer-facing terminal services, covering 8 types of operational roles and achieving an average efficiency improvement of over 70%. At the same time, it has supplemented the discovery and evaluation processes in hyperautomation, conducted intelligent analysis and optimization of the "Outward Remittance" and "Branch Card Application" business processes, and won the "Smart Craftsman" award for outstanding cases.

Become the choice of more enterprises Improve efficiency Reduce costsAchieve operational excellence

View customer cases