Agentic automation solutions

Become the choice of more enterprises Improve efficiency Reduce costsAchieve operational excellence

View customer cases Automation

Automation

We enhance efficiency, achieve business process automation, optimization, and high scalability

Improve process efficiency through automation, achieve automation, optimization and high scalability of business processes, and bring excellent efficiency and reliability to your organization

The People's Insurance Company (Group) of China Limited (hereinafter referred to as "PICC") evolved from the People's Insurance Company of China, which has grown and developed alongside the Republic of China. On October 1, 1949, the company's establishment was approved by Mao Zedong and other central leaders, and it was hailed as the "eldest son of the insurance industry in New China". It is the pioneer and founder of China's insurance industry.

After more than 70 years of development, PICC has now become a comprehensive insurance and finance group, with more than 10 professional subsidiaries under its umbrella, covering property insurance, personal insurance, reinsurance, asset management, real estate investment and alternative investment, financial technology, and other fields.

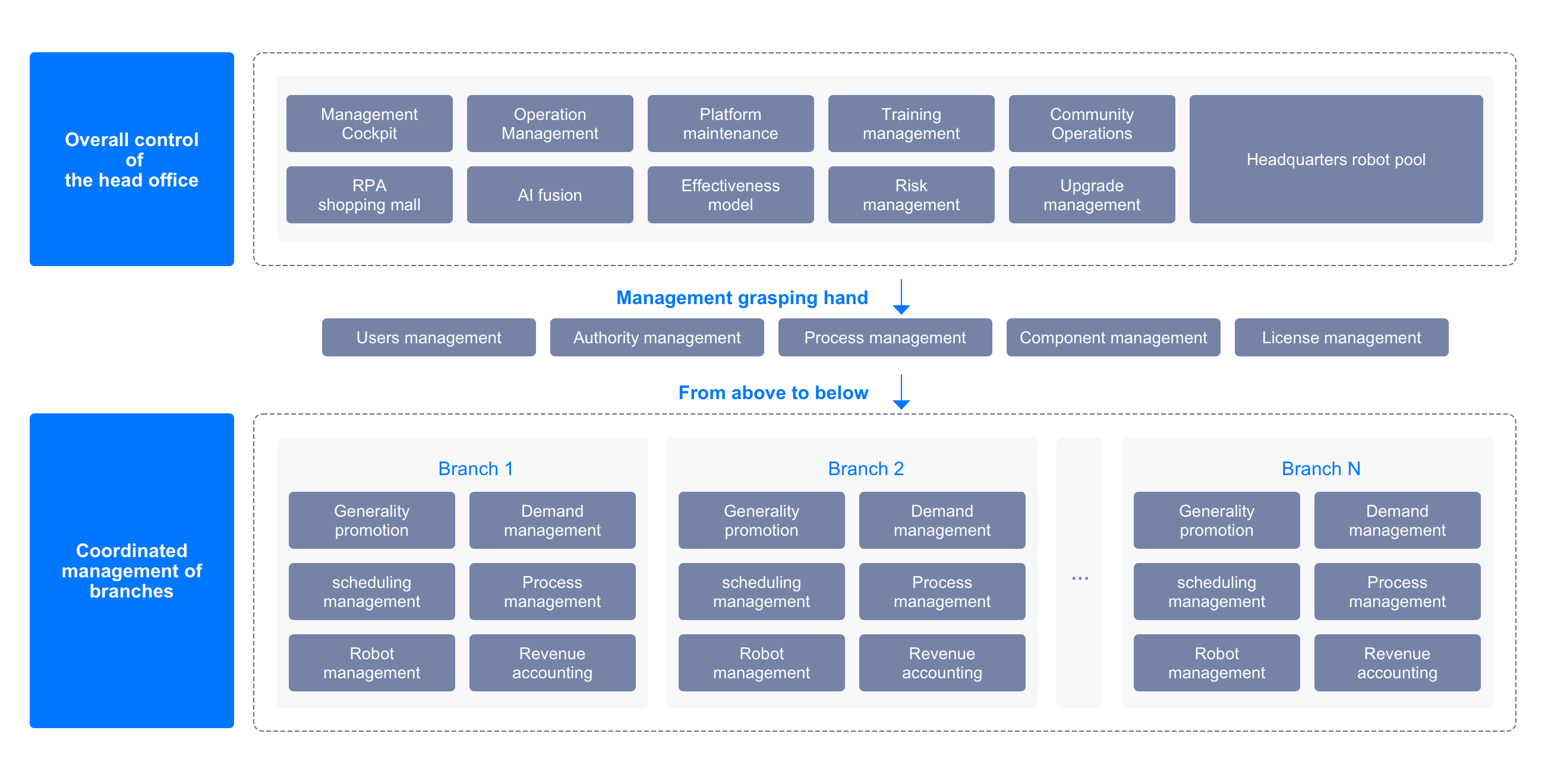

i-Search has partnered with PICC Technology to unify the RPA products across the entire group, covering the entire group's business of core subsidiaries including personal insurance and property insurance. Through headquarters coordination, a linkage between the head office and branches has been formed, covering 22 branches nationwide and launching over 300 automated processes.

Manual processing is time-consuming and has a high error rate

The expansion of business scope and the growth of business volume bring pressure on efficiency

Lack of a unified operation and management platform

Over 600 automated processes have been launched

Headquarters coordination, headquarters and branches linkage, covering over 30 branches nationwide

Save 53 million yuan in costs and increase efficiency by 80%

To address issues such as centralized processing of PICC business, repetitive manual operations, and susceptibility to errors, RPA applications have been piloted in the headquarters and multiple branches in Tianjin, Hebei, Chongqing, and Anhui, covering scenarios such as finance, claims processing, and general office work.

RPA is scaled up to address the pain points of more business personnel. Organize scaled RPA training courses to enable business personnel to solve their own pain points and improve office efficiency through training, thereby expanding the scope of RPA application.

Overall coordination and collaborative promotion are conducted, covering 31 branches and 9 business lines through promotion, with over 260+ online processes

Fully promote the "digital employee" concept, leveraging robotic process automation (RPA) technology to enhance the quality and efficiency of insurance services, and extend RPA process automation to multiple areas such as customer service, claims processing, asset management, and finance.

Deeply integrate AI technology, explore the application of large model integration, vigorously promote the application of digital employees in a systematic, large-scale, and standardized manner, effectively enhance operational efficiency and human performance, and facilitate the automation and digital transformation of company operations.

Become the choice of more enterprises Improve efficiency Reduce costsAchieve operational excellence

View customer cases